What Does Offshore Banking Do?

Table of ContentsLittle Known Facts About Offshore Banking.Examine This Report on Offshore BankingOffshore Banking for BeginnersNot known Details About Offshore Banking The Basic Principles Of Offshore Banking

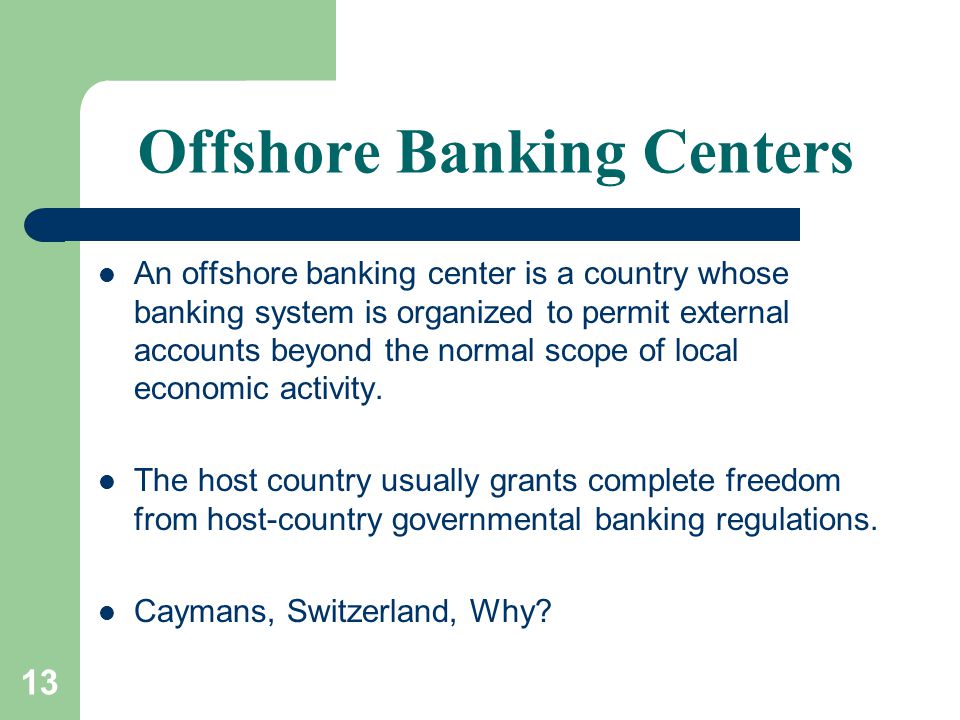

Bank situated outside the nation of residence of the depositor An offshore financial institution is a bank regulated under global banking permit (often called offshore license), which usually prohibits the financial institution from developing any kind of company activities in the territory of establishment. As a result of less law and transparency, accounts with overseas financial institutions were typically made use of to conceal undeclared earnings. OFCs often also levy little or no firm tax obligation and/or individual revenue and also high straight taxes such as responsibility, making the price of living high. With worldwide raising steps on CFT (fighting the funding of terrorism) and also AML (anti-money laundering) conformity, the overseas banking field in many jurisdictions underwent changing guidelines.

OFCs are claimed to have 1. A team of protestors specify that 13-20 trillion is held in offshore accounts yet the genuine number can be much higher when taking into account Chinese, Russian as well as US release of capital globally.

How Offshore Banking can Save You Time, Stress, and Money.

A lot like a criminal using a budget identified as well as confiscated as proceeds of criminal offense, it would certainly be counterintuitive for anyone to hold properties unused. Much of the capital flowing via lorries in the OFCs is aggregated financial investment resources from pension plan funds, institutional and also exclusive investors which has actually to be deployed in industry around the World.

Financial advantages [edit] Offshore financial institutions give access to politically as well as economically stable jurisdictions. This will certainly be an advantage for citizens of locations where there is a risk of political turmoil, that fear their properties might be frozen, seized or go away (see the for instance, during the 2001 Argentine recession). It is additionally the situation that onshore banks supply the exact same advantages in terms of security.

Getting My Offshore Banking To Work

In 2009, this content The Island of Male authorities were keen to aim out that 90% of the claimants were paid, although this only referred to the number of individuals who had actually gotten money from their depositor payment system and not the amount of cash reimbursed.

Only offshore centres such as the Isle of Guy have actually refused to compensate depositors 100% of their funds adhering to financial institution collapses. Onshore depositors have been reimbursed in complete, regardless of what the compensation limitation of that nation Bonuses has actually stated. Thus, financial offshore is historically riskier than banking onshore.

Offshore banking is a legitimate monetary solution made use of by numerous expatriate and also global workers. Offshore territories can be remote, and also for that reason pricey to check out, so physical access can be difficult. Offshore personal banking is normally a lot more accessible to those with higher earnings, due to the fact that of the costs of establishing and maintaining overseas accounts.

The 4-Minute Rule for Offshore Banking

1 Record of Foreign Financial Institution as well as Financial Accounts (FBAR: Everyone or entity (consisting of a financial institution) topic to the jurisdiction of the United States having a passion in, trademark, or other authority over several bank, protections, or various other monetary accounts in an international country must file an FBAR if the accumulated value of such accounts at any kind of point in a fiscal year exceeds $10,000. offshore banking.

24) - offshore banking. A recent [] District Lawsuit in the 10th Circuit may have substantially expanded the interpretation of "interest in" and also "other Authority". [] Offshore savings account are occasionally touted as the option to every legal, monetary, and possession security strategy, yet the advantages are commonly overstated as in the much more prominent jurisdictions, the degree of Know Your Customer proof called for underplayed. [] European suppression [edit] In their initiatives to stamp down on cross boundary rate of interest payments EU federal governments consented to the introduction of the Savings Tax Obligation Instruction in the form of the European Union withholding tax in July 2005.

This tax impacts any kind of cross boundary rate of interest settlement to a specific citizen in the EU. Furthermore, the price of tax deducted at resource has actually risen, making disclosure significantly attractive. Savers' choice of action is complicated; tax obligation authorities are not stopped from enquiring into accounts formerly held by savers which were not then divulged.

Top Guidelines Of Offshore Banking

e. no one pays any type of tax obligation browse around here on offshore holdings), as well as the similarly interested narrative that 100% of those down payments would certainly otherwise have actually been reliant tax. [] Forecasts are typically asserted upon levying tax obligation on the resources amounts kept in offshore accounts, whereas a lot of nationwide systems of taxes tax income and/or funding gains as opposed to accrued riches.

3tn, of offshore possessions, is possessed by just a tiny sliver, 0. In simple terms, this mirrors the trouble associated with establishing these accounts, not that these accounts are just for the wealthy.